Providers we partner with

What is Pet Insurance?

Pet Insurance is a great way to make sure you can afford to pay vet bills if your dog or cat gets sick or injured. Vet bills are getting more and more expensive each year, so if you’d find it difficult to pay several hundred or even several thousand dollars out of your own pocket to cover the cost of one, pet insurance could be a smart option for you.

Why you can trust WeCompare

Getting a quote for car insurance used to be a frustrating task, but not with WeCompare! We officially partner with America’s leading Car Insurance providers, like Geico, Progressive and State Farm, to make getting a quote quick and easy. It’s how car insurance should be.

52 years

of industry expertise

39.7k

ZIP codes examined

60 secs

to get a quote

How does Pet Insurance work?

When you take out a pet insurance plan you select the amount of annual coverage you want to be covered for, plus your deductible and copay (sometimes called ‘out of pocket expenses’). Then, when you get a vet bill, you will be able to claim back the total of the bill up to the amount of annual coverage you’ve chosen, less your deductible and copay.

Here’s an example of how it works:

Your Pet Insurance Plan

Unlimited

Coverage

$250

Deductible

10%

Co-Pay

You get a vet bill for $2,000

You’ll pay $450 in out-of-pocket expenses, and claim back the remaining $1,550 from your insurance company

Is Pet Insurance worth it?

Pet insurance is not perfect, but one of the questions you have to ask yourself is, ‘Would I be able to pay an unexpected vet bill for a few thousand dollars?’ If the answer is ‘no’, pet insurance is at least worth thinking about – and getting a free quote through WeCompare is a great way to see if it might be right for you.

The average plan costs just $45 per month for a dog and $25 for a cat.

$45/mo

$540/yr

Avg. monthly for a dog

$25/mo

$300/yr

Avg. monthly for a cat

Do I have to have Pet Insurance?

No. Unlike auto insurance, pet insurance is not mandatory – but the consequences of not having cover can be serious.

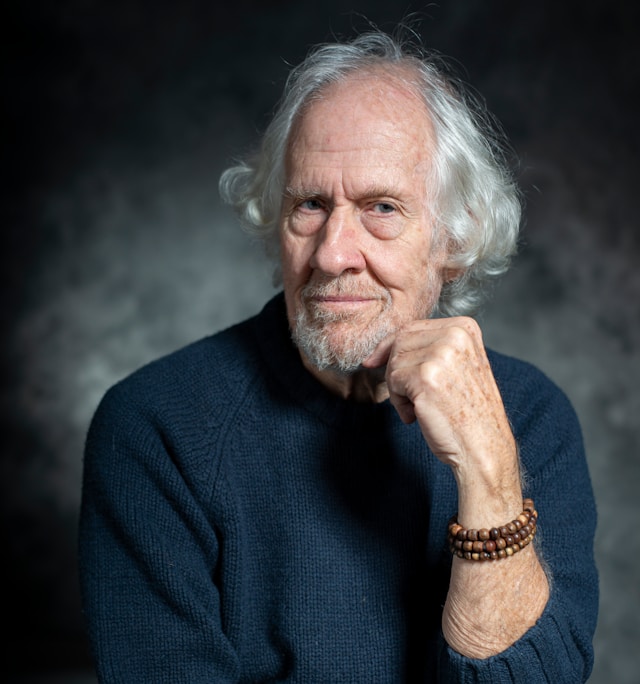

“One of the toughest parts of veterinary medicine is when we may have options to diagnose and treat a pet in need, and the pet parent declines due to financial constraints,” says Dr. Kevin McEvilly, Director of Veterinary Medicine at Palms & Paws Veterinary Center in Santa Monica, CA. “When we remove the burden of cost, our potential to do whatever is best for each and every pet is unlocked – I believe pet insurance is an excellent way to accomplish this.”

When we remove the burden of cost, our potential to do what is best for each and every pet is unlocked – I believe pet insurance is an excellent way to accomplish this

Dr. Kevin McEvilly DVM

Chief of Staff & COO, Palms & Paws Veterinary Center in Santa Monica, CA

What does pet insurance cover?

Pet insurance covers your pet for any accident and new illness. So this means whether your dog has a leg break or gets hit by a car, or has anything from an ear infection to cancer, your pet insurance policy will cover you – up to the amount of annual coverage you chose. A good way to look at it is that pet insurance is here for all the things you don’t know are going to happen in life.

What doesn’t pet insurance cover?

The main thing pet insurance won’t cover you for is pre-existing conditions – which basically means something you knew your dog or cat had before you took out the policy. A good way to look at it is that pet insurance is there for stuff that might happen in the future, not something that’s happened in the past.

Saying all that, some insurers – like Embrace, Spot and ASPCA Pet Health Insurance – do distinguish between pre-existing conditions and curable pre-existing conditions. With Spot, for example, if your pet has been treated for a condition and stayed symptom-free for 180 days, the company will consider it cured.

What does pet insurance cost?

Typically you can get pet insurance for around $45 per month for a dog and $25 for a cat, but that’s only a rough guide. The cost of pet insurance depends on a lot of things, like your zip code, the breed of your pet and how old they are. Why?

The Best Pet Insurance for 2024

WeCompare partners with the biggest and most trusted names in pet insurance to bring you the best prices – as quickly and easily as possible!

What is the best pet insurance?

The best pet insurance is a policy that offers the most comprehensive coverage – but you need to consider your budget, too. Premiums vary, so our tip is to look at what each insurer covers; you may find cheap pet insurance but it could turn out to be more expensive if it doesn’t provide the correct type of cover.

Pet insurers offer accident and illness cover, and some offer just accident only. If you choose accident only, it’s likely that your premium will be lower, but your pet won’t be covered if it falls ill.

What is the best time to get pet insurance?

The best time to get pet insurance is when your pet is young. So, with dogs, we’d recommend taking out a policy if you have a puppy. Why? Well, insurers see older dogs as more of a risk in terms of getting ill; some won’t insure dogs even as young as six, while others might only offer accident-only cover. Generally, older dogs are more expensive to insure. They may also have pre-existing conditions that won’t be covered.

| Age | Average monthly premium* | Average annual premium* |

|---|---|---|

| < 1-year-old | $90.82 | $1,086.42 |

| 1-year-old | $88.63 | $1,060.12 |

| 2-year-old | $89.44 | $1,069.91 |

| 3-year-old | $90.74 | $1,085.42 |

| 4-year-old | $96.06 | $1,149.32 |

| 5-year-old | $71.09 | $849.61 |

| 6-year-old | $79.73 | $953.36 |

| 7-year-old | $94.03 | $1,124.92 |

| 8-year-old | $113.89 | $1,363.26 |

| 9-year-old | $133.34 | $1,596.66 |

90% / $250 / Unlimited or highest

Can I customize my plan?

This depends on the insurer but yes, there are often opportunities to customize your pet insurance plan. You may be able to adjust your annual coverage limit – the higher it is, the higher the premium is likely to be.

Also, some pet insurers will include types of cover in their policies, while others won’t and will instead offer these as optional extras. This means you can customize your plan as you choose, adding cover for behavioral therapies, dental illness, prescription food, supplements and physiotherapy if you wish. All at additional cost, though.

Watching finances limit treatment options is such a challenging aspect of veterinary care. Pet insurance leads to greater diagnostic flexibility, more treatment choice, and ultimately, improved patient outcomes

Dr. Georgia Jeremiah

Furmacy Co-Founder and Veterinarian

Why do I need to give my zip code to get a quote?

We’ll ask you for a few details when we search for pet insurance quotes; among these is your zip code. This tells us where you live. We need to know this so insurers can analyze the cost of veterinary treatment in your area. Along with your pet’s age and breed, where you live is a key factor in determining the price of insurance.

The rates above are based on a one-year-old Medium Mixed Breed dog, in Zip Code 90292. Just answer a few questions and get a personalized set of rates that are ready to buy if you are.

Pet Insurance Glossary

What are pre-existing conditions?

Pre-existing conditions are those which your pet had before taking out a policy. So, if your dog has previously sustained a knee ligament rupture, you take out a pet insurance policy, and then you later decide your pet needs an operation to resolve the issue, you won’t be covered for the cost. In the event of any claim, your insurer will ask to see your veterinary records and if that condition has been diagnosed before you took out the plan, you won’t be able to claim for it.

What is annual coverage & how much do I need?

Annual coverage is the amount of cover you’re entitled to in every year of your policy. It’s an important detail. Many pet insurers, Spot and Embrace among them, offer unlimited annual coverage, so you can claim for any cost of treatment.

However, if the annual coverage is capped at a specific amount, be aware you can only claim for treatment and costs up to that amount. So, if your pet insurance policy has annual coverage of $5k, and your pet needs an operation with associated treatment costs totalling $8k – for example – you’ll have to fund the difference yourself.

What is a deductible?

A deductible is the amount of money you need to pay towards any charges or fees, before your policy pays out for the rest. You can usually set this yourself before you take out pet insurance. It’s typically the case that the higher the deductible, the lower the cost of your premium – if your deductible is $500, your overall pet insurance price will be lower than if your deductible is $250. But this also means that for any claims of $500 or lower, you’re responsible for the full vet’s bill.

What is reimbursement?

Reimbursement is when your pet insurer pays you, the policy holder, back for their share of any claim. In the event of a claim for treatment, some pet insurers will pay the vet directly – less your deductible – but often, you pay the vet, submit a claim, and your insurer then reimburses you.

What is a Wellness plan?

A Wellness plan, included in a pet insurance policy, covers routine veterinary appointments. While pet insurance is in place to help with the cost of unexpected illness and injury, a Wellness plan covers services such as vaccinations, vet check-ups, flea and worming treatments.

HOW WECOMPARE WORKS

Free reviews, advice and money saving tips tailored to our users.

FAQS

Does pet insurance cover spaying and neutering?

Many pet insurers won’t cover the cost of spaying or neutering, which are procedures to stop your pet from reproducing. Both are seen as an elective procedure (it’s scheduled and by choice), not as an accident or illness. But may be covered as part of a wellness plan – ask your insurer about this.

Does pet insurance have dental coverage?

Yes – some pet insurers include the cost of dental coverage and treatment within their policies. Embrace, for example, covers your pet for up to $1,000 in dental coverage per year. Others don’t, but offer dental coverage as an optional extra.

Does pet insurance have discounts?

Some insurers might offer discounts on their pet insurance. For example, Embrace offers a 10% multiple pet discount, if you insure two or more pets – and other insurers offer similar incentives. Some insurers also offer a discount for customers who are active, and former, members of the military.

How do you claim your money back?

While some insurers will pay your vet directly for any treatment covered by your pet insurance policy, it’s more typical that you will pay, before then being reimbursed. To do this, you’ll submit a claim for the treatment – usually including an invoice from your vet and any relevant paperwork – to your insurance company. They will then pay your claim, minus your deductibles that apply to your policy.

Does pet insurance have networks?

No, pet insurance doesn’t have provider networks – there’s no list of vets you must select from when it comes to choosing treatment (as there is with health insurance). This means you can use any vet; you’re not limited to certain veterinarians only.